America has three major housing issues for seniors: affordability, physical accessibility, and access to medical care and other services. There is a need for creative solutions to housing.

The Misconceptions Millennials Have About Social Security

On August 14, 1935, the US federal government launched its social insurance program to provide retirement, disability, and survivor benefits. Since that time, in part due to the disappearance of extended family networks, an increase in population, and a profound increase in life expectancy, it has become challenging for the Social Security Administration (SSA) to maintain the benefits promised to Americans.

According to a Transamerica survey, 80 percent of Millennials (born between 1979 and 2000) do not think they will receive any Social Security benefits at all. This apprehension comes as no surprise because for decades Americans have been saying that the Social Security benefits system is going to go broke. Millennials may be right to be skeptical about receiving benefits three and four decades hence, and the program does have problems but is not going broke, yet.

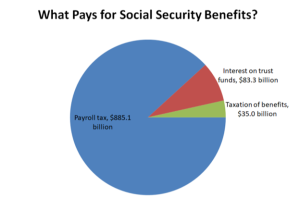

By its admission, the Social Security Administration reports that the Old-age and Survivors Insurance (OASI) Trust Fund and the Disability Insurance (DI) Trust Fund are scheduled to be depleted in the year 2034 if Congress doesn’t act. However, there is another source of income for Social Security benefits. Even in the absence of both SSA Trusts, hundreds of billions of dollars in payroll taxes will still be collected and billions in benefits will still be paid. Even if Congress did not intervene to address the current challenges, the system would still be able to pay 77 percent of projected benefits beyond the year 2034.

Because of the bipartisan support the Social Security program receives and influential lobbies including the very powerful American Association of Retired Persons (AARP), it is highly probable that Congress will intervene to strengthen Social Security’s finances. Millennials’ uncertainty about the program’s solvency may lead to poor decision-making regarding their retirement savings and plan. It is never too early to start looking at the basic tenets of when you will be able to retire successfully: https://www.nerdwallet.com/blog/investing/when-can-i-retire/?utm_campaign=ct_prod&utm_source=ap&utm_medium=mpsyn. Just because Millennia consider the future of Social Security benefits as tenuous, it should not deter them from saving money, investing, and reviewing and updating plans as circumstances change.

Data source: Social Security trustees

The average Social Security benefit is currently slightly less than 1,500 dollars a month. To successfully use the financial planner’s 4 percent rule would require a savings of 400,000 dollars to generate a similar income to the average Social Security benefit. Projections by the Urban Institute estimate that Millennials will receive about one million dollars for a single adult of average income and 2 million for a couple.

Maybe the good news about Millennials’ skepticism about the solvency of Social Security is their interest in starting retirement savings planning earlier than the generations before them. Millennials who are saving are beginning around 24 years old and with good reason. Pensions in the private work sector are becoming increasingly rare, employers may go out of business, and job-hopping is much more common among younger American workers, which can easily lead to errors in income reporting.

All Americans should create an account on the Social Security Administration’s website, which allows you to check your earnings records and have errors corrected. Even checking every three years is good enough to know that your Social Security benefits will track accurately based on your income. Before ever claiming your benefits, be sure to employ one of many software tools that educate you about claiming strategies for Social Security. Millions of Americans make the mistake of taking their benefits too early, which locks them into permanently reduced payments. The financial incentives the SSA provides for delaying when you take your benefits can net you up to 250,000 dollars more. Benefits currently increase between 7 to 8 percent for every year you delay after the age of 62, capping at maximum benefits at the age of 70.

Millennials are expecting their prime source of retirement money to come from self-funded financial vehicles like a 401(k), IRA, and other savings and investments, and ultimately that is a good thing. There isn’t such a thing as “too much money” in retirement, so additional sources of income beyond Social Security benefits are an excellent strategy. The social contract the federal government made for, and funded by its citizens, in all likelihood will be there for the Millennial Generation but no one knows the future. With 18 percent of Millennials expecting to live to 100 years of age or more getting information and advice about how to achieve retirement goals is more important than ever before.

We hope you found this article helpful. If you have questions or would like to discuss a personal legal matter, please contact our office at 732-972-1600.